Of course, we’d all love to save $1,000 a month, but that’s just not realistic for the vast majority of people. Be realistic about your saving expectations Once you deduct your total expenses from your salary, you’ll have a clearer picture of what disposable income you have left.

HOUSEHOLD BUDGET EXAMPLE UPDATE

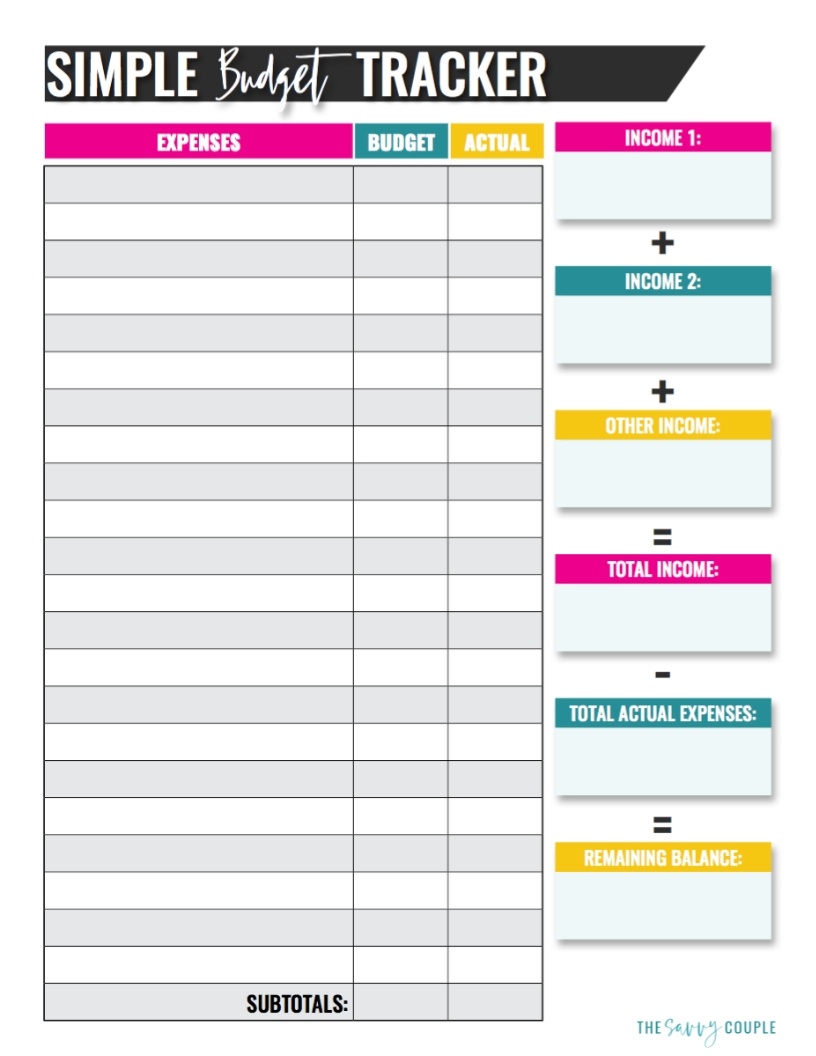

Even better, have this information stored in an online, secure document, so you can access it anywhere and update it as your life circumstances change. If you think having all this assigned to memory is too big an ask, try using Excel to make a budget worksheet. Having a clear understanding of the funds you bring in each month, and money you pay out is essential you can’t manage a budget if you don’t know what your budget actually is. You may think terms like “cash flow” and “expenses” are only used in the office, but being good with money is universal, whether you’re running a business or just making sure your family isn’t overspending. Introduce some of these budgeting tips into your home, to set a great example for your children and to make your life all the easier. Creating positive spending habits and running a personal budget are life skills everyone should know, including kids. Are you insured twice perhaps? Are you paying for subscriptions or memberships that you hardly ever use? You would be amazed how much money you can save.Whether you’re saving up for a sunny vacation or just counting the pennies for a rainy day, personal finance should always be top of mind when it comes to your household. In addition, with the personal financial assistant, budgets and savings goals can be automatically updated by the account activity and much more.īy taking a closer look you can also learn where your household can best make savings. So you have all income and expenditure information available at any time, at a glance, on your computer, Tablet or smart phone. The bigger the piece of pie, the bigger the outgoing. You can see on a pie chart how much your monthly expenses are and what they are for. It supports you with the initial setting of the household budget, in that all the information is automatically categorized and graphically laid out. Your personal assistant can help you learn about possible savings with e-Banking and Mobile Banking. When you use our planner’s help to manage your budget, you can see in detail how much your car and your mobile cost per month. Your personal financial assistant helps you set your household budget Whilst you input the information it automatically calculates your household budget for you. In this you can enter all your income and expenditures. Among other things the Online Budget calculator of the Swiss Advisory Council. If you don’t want to list everything individually there are some helpful tools. Then list down all your costs carefully including the various insurance policies, living costs, tax, household, health, travel and leisure activities. Firstly, work out your total income from salary, premiums, pension rights and assets. To calculate the household budget list your most important income and expenditure separately. When some individual amounts vary greatly, you can take for example an average over the last six months. In the household budget you should insert the actual amounts. Even if you plan or wish to spend less on clothes or leisure activities. When you set your household budget it is important that all the information is truthful. Setting the household budget: Where does your money go?

Thus you will have the best chance of making a profit out of your household budget by year end - just like in a successful business. And you can quickly see where you could perhaps save even more. Thereby seeing at a glance what you have left over from your income each month. Sounds good! But for that you need to know how much you spend and on what. At the end of the year ideally you will have received more than you have paid out - and have money left over with which to fulfill a dream for example or to be able to save for something in particular. Imagine you are the Managing Director of this firm. Your household functions like a business.

0 kommentar(er)

0 kommentar(er)